Can You Really Turn $0.01 into $10 Million?

Have you heard about the magic penny before? What about turning one little penny into over $10 million? No?

Well, before we go on to talk about this magical penny, let me ask you a simple question and I want you to answer it honestly.

Would you rather have $1 million or one penny doubled every day for 31 days?

I’m going to bet that 95% of you are going to pick the million dollars. Heck, that’s quite tempting isn’t it. To have one million dollars in cash just sitting there waiting for you. Oh, it gives me goosebumps.

The other 5% of you would pick the penny doubled and I applaud you. Why?

Because it’s the right answer. You’re thinking with a long-term view over the the immediate gratification view. I used to be a part of the 95%, but I’ve since changed my thought processes ever since I got out of consumer debt.

Some of you are probably shaking your head thinking that a penny is worthless. I think someone called it a pocket weight at one point in time. I hate getting and carrying around pennies, but if I can get one to double in value per day for 31 days, then I’d love me some pennies.

Before you head over to the “x” button in your browser, let me show you some simple math that makes the penny so enticing. I’m going to show you the simple concept that has changed my mind about saving and investing my money. I’m going to show you what compound interest is all about. Some have called it the eighth wonder of the world. I would consider it as well after doing the simple math around it. Compound interest really does rock my socks off!

How One Penny Turns into $10 Million

When I first heard about turning $0.01 into over $10 million in just one month, I thought it was crazy. My head was spinning just trying to figure it out. The math didn’t work in my head. Now, I heard about this trick a long time ago, but never talked about it on this site. I’ve spoken about compound interest before, which is why investing and saving is so worth while. It’s really the only way I will be able to retire. It’s the only way for most people. Compound interest is helping me retire people!

[clickToTweet tweet=”Would you take $1 Million or $0.01 doubled every day for 31 days?” quote=”Would you take $1 Million or $0.01 doubled every day for 31 days?” theme=”style6″]

It wasn’t until I actually put this little math conundrum down on paper (OK, it was Excel) that I truly see how it works. Here is the background. If you could double $0.01 every day for one month, what would you get? You’re probably thinking just like me and saying “not much!” It’s hard to comprehend this little equation. I noticed another site some time ago ask if you would rather take $1,000 each day for one month or double $0.01 everyday for one month. Most people would take the $1,000 per day!

I just upped the money to $1 million to make it even more enticing. More people would take that $1 million and run with it. It’s just too tempting and it’s an amount most people couldn’t fathom having in their possession. A few years ago, I would’ve done the same thing.

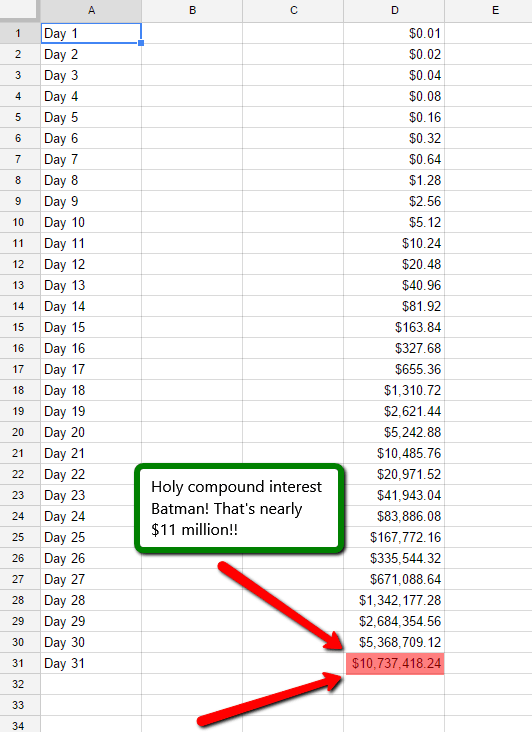

Want to guess what you would have if you double $0.01 everyday for one month? Let me break it down…

Do you see that up there? Yes, $10.7 million when you take $0.01 and double it everyday for a month. Wow, that’s the real power of compounding interest. This is the same thing that powers investments and savings in general.

Now, let me speak some truth first. This little math trick is to just show you the real power behind compound interest. You won’t find any investment or savings account that provides you with 100% returns. That would be unrealistic and you shouldn’t focus on that. It just won’t happen!

Related: Start investing today with Betterment for as low as $25!

I show you this because I know and speak with people regularly who don’t understand compound interest. They don’t think investing is for them or don’t have time to start. I get a little cringe in my neck every time I hear it. I get that cringe because I used to be that way. “I’ll save tomorrow” was a statement that came out of my mouth on a regular basis. The same thing goes with investing. I didn’t know how to do it and it sounded like something only the one percent could do.

Well, I was wrong folks. I was way wrong!

This little math lesson isn’t to get your hopes up, it’s to get you to understand that holding money for a long period of time can reap great rewards. Too many of us are focused on instant gratification, but if you’ve never talked to a lottery winner, then you’d might not know that it usually ends in failure.

Let’s Check Out Some Real Numbers

OK, I know the math up there looks great and you might be irritated that this isn’t some get rich quick scheme. As noted, I put this together to show you how compound interest really works. It’s how investments gain value over time and how people can retire with money in the bank.

To show you some real numbers might make this a little more real for you. Let’s start with $100. You can start a Betterment account for $100 (actually less) and start investing with a long-term strategy in minutes. I’ve been with them since 2012.

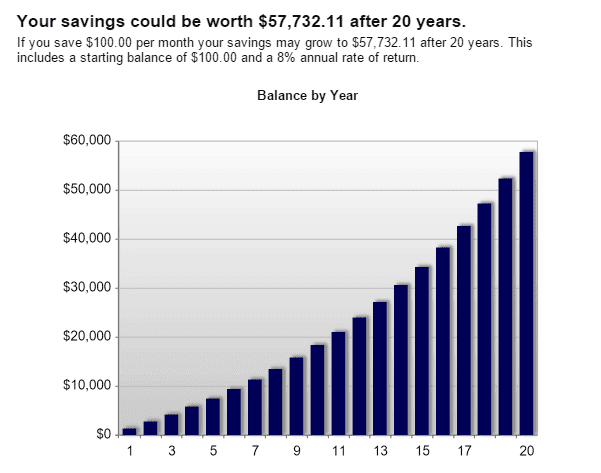

If you were to invest starting with $100 and you contribute $100 to your investment account per month, how much do you think you’d have after 20 years? Seems like a long time, doesn’t it? Remember, investing and compound interest work best over the long run, so it’s not a short-term game to play.

What if I told you, with those numbers, you’d save $57,732 by just starting with $100 and adding $1,200 per year. That is very doable for most people.

The graph gives you a little visual break down on how this works, but the 8% rate of return is very doable. In fact, over the last 30 years, the S&P 500 has averaged a 10.7% return. Yes there are ups and downs, but that’s why we invest for the long run. So, when people say you can’t get 8% returns, it’s just not true. Tell them to look at historical averages of what has already happened.

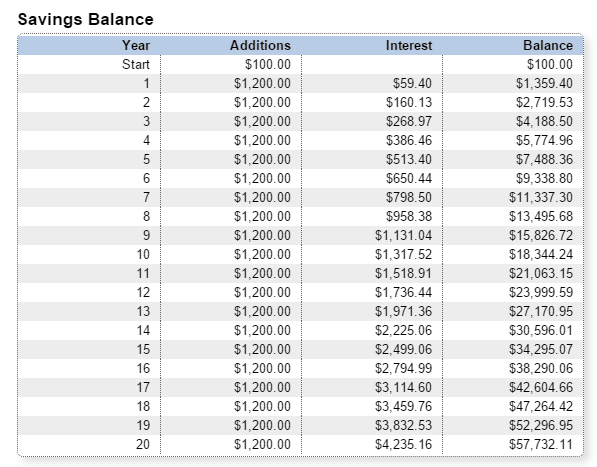

Here is the amortization break down for you for each year and how much interest you receive. As your balance increases, so does the interest you earn.

Not bad for just $100 starting out and $1,200 per year. Who wouldn’t want to earn $33,632 in interest over 20 years? Without compound interest, much of your saved money will do nothing. If you don’t invest it, it won’t go anywhere and it won’t beat inflation. Just remember that.

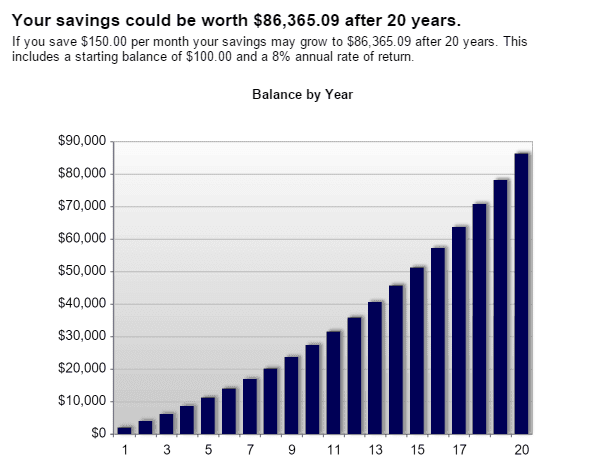

What if we bumped up the monthly contribution to just $150? Just another $50 per month. How will that change the equation?

And just like that, with an extra $50 per month ($600 per year), you could have over $86,000 in your account with the same rate of return and only starting with $100. That’s quite a nice leap there. In this equation, you’re earning over $50,000 in interest alone. I’ll take that any day!

Everyone Should Save and Invest

I say this because I mean it. I think everyone should save and invest. It doesn’t matter how much money you make, there is always a little something you can put aside. Don’t think so? Well, take a deep look into your expenses as you might be over paying for a service or buying stuff you don’t actually need. Too many people live paycheck to paycheck and don’t know how to get out. You get out with will power, smart money management, and using the power of compound interest to your advantage. Help your money make money for you. That’s what everyone should do!

Related: I manage all my finances with a free Personal Capital account. It’s the best thing since sliced bread!

I know many of you think it can be hard to save money, but usually priorities are mixed up when that comes into play. Too many focus on wants over needs. Instant gratification drives our purchase decisions because we can’t think of the long term. We want it now and don’t want to wait. Maybe we can blame Amazon for that!

I recommend Betterment for beginner investors because I know and use it. If you’re more advanced, then check out TradeKing, Scottrade, or Vanguard.

While you can’t expect earning a hot 100% return, investing is how I’m charging ahead toward retirement. The S&P 500 has averaged around 10% annual return for the last 30 years. While there are some ups and downs (that’s normal), the average return is 10%. You can’t get that in a savings account. It won’t happen these days. If you never started investing, then you can learn more here. I would recommend starting with a retirement account, such as a Roth IRA. Retirement is important and investing is how you get there! Just imagine earning 10% on your money every year for the next 30 years. That can be empowering! That’s compound interest my friends!

If you’ve never invested before or aren’t sure how to do it, that’s OK. We have you covered for all age groups. Just pick where you fit and see how easy it really is…

- Investing in your 20s

- Investing in your 30s

- Investing in your 40s

- Investing in your 50s

- Investing in your 60s and retirement

Well, there you have it. That’s how you can turn one penny into over $10 million in a month. It’s the power of compound interest and I love it! Sometimes it’s hard to comprehend something we don’t truly understand. Most people, including myself would say this is impossible and it doesn’t work, but the Excel sheet up there says otherwise. I wasn’t a believer for a long time. I didn’t really care about anything but my bank account balance. I was foolish and shortsighted. I didn’t long term. I was just focused on now. I’m lucky enough to have figured it out in my twenties. Others may not be so lucky, but it’s never too late to start stashing away money for retirement. Trust me, it’s never too late!

What do you think about this little math problem? Did you think it was possible?

If only we could receive a 100% return on our money! Our money is not likely to double every day, but at 8%, we can be sure it will double every 9 years. (using the rule of 72). Starting at age 18 with $1,000 and doing nothing else, you can expect to have $2,000 by 27, $4,000 by 36, $8,000 by 45, $16,000 by 54 and $32,000 by age 63. Think about it, just put that $1,000 aside 18 year olds and you don’t touch it and you will have quite a sum when you need it most.

I wish we could! You’re right though. Just look at what $1,000 can do just with compound interest.

What bank or account can i get in order to get 8%

There is no bank account that can get you 8%. This post is about investing and using compound interest. If you want to earn 8%, you need to invest your money. Try a company called Betterment for starters. 8% is NOT guaranteed. You can also lose money.

Had I not read this article and had someone ask me the question of which I’d prefer, I absolutely would have taken the $1,000 / day option! I’ve always understood the idea of compounding interest (thanks grandma!) but seeing it in that kind of form is incredibly enlightening. Hopefully those who don’t understand the idea of compound interest or who haven’t starting investing/saving see this and get to it! Thanks Grayson!

I was the same way. You can easily see $1,000 per day, but the $0.01 doesn’t really do much in our minds. It wasn’t until I popped this into a spreadsheet that is really blew my mind.

I asked my mom about this one day and she picked the $1,000/day until I explained it to her. Then she quickly changed her mind, haha.

Yeah, $31,000 compared to $10 million is a no-brainer!

Things like that never make sense to me until I see it written down. It’s hard to think about compound interest and how well it works, but numbers don’t lie.

I agree Kim. It blows my mind once I see it.

I hadn’t heard that line about compound interest being the 8th wonder of the world, but I love it! Seeing the figures about the value of compounding makes me glad that we’re working so hard to save in our 30’s, but makes me wish that we had worked harder to invest in our early 20’s!

I heard it some time ago and I believe it now! I wish I had saved more in my 20’s, but am doing my best now.

Hey Grayson,

Thanks for spreading the Digit love!

This brings up an oldie but goodie of mine http://www.thewaytobuildwealth.org/2008/11/the-most-powerful-force-in-the-universe-compound-interest-episode-7/

🙂

Given the two options, without understanding the power of compound interest, I would have thought $1k/day would have been a better deal. My little bacon brain finds it difficult to project the earnings of compound interest. Thirty years of investing, saving and growing money in retirement can feel distant. Its great to be reminded that adding time to your money can really make your money sizzle.

I was the same way. Seeing $1k a day would be awesome, but it doesn’t compare to the other option. We love to see large numbers, but can’t project them ourselves.

i would take 1k$ a day for sure if i dont get 100% profit of the 0.01$ double a day , because there is no point in that , people who live the safe mode would say i’ll go for the double 0.01 and for 30 years or more i’ll be at 60’s 70’s of my age and i would have a good money for my age , but whats the point of having such money if you are on the edge of death , doesnt worth , its remind me of a story someone told me about a guy who spend more than 50 years of his life buying lottery tickets , when he came to age of 80’s he won the lottery , the first thing he did in public he tear it apart .

money without time doesnt worth a thing , but both together is a success for example , days ago i came a cross a video showing David Choe a graffiti guy , and i’m an artist by my self i always wonder how i could make a living and having my own studio and time and money i could work without fear of tomorrow , and i’m asking my self how this guy make a living , and when i read articles suddenly its like ohhh he got one shot of chance and he used it 200million$ worth of shares took about 5 years only , and i’m questioning my self how that doubled it self in this short period 5 years and how much percentage of profit we are talking about ? , if i look at compound interest we dont get 100% but we may get 2% where the rest go ? to whom? how can i increase the percentage to 80% – 90% , lets be logic i have to give some in return thats why not logic to have 100% , and i’m sure those shares that become 200million $ in a 5 years they have doubled in a system way which not explained not revealed , we could know how basically compound interest work as the way you explained but if thats it ?no farther ? not getting deep into things that shows why i cant get a huge profit of it and someone tells me dont even think about having the 100% or even the 80% of it , its realy pointless and very disturbing

This is a completely theoretical calculation. I think you’re looking too deep into this post. The point of the post was to make sure you understand the concepts of compound interest. Yes, you won’t find something that gives you 100% return, but that doesn’t mean you can’t find 10% or more. You’re digging for something that doesn’t exist in this post. This is showing people who are reluctant to save/invest to do so. That’s how you can grow your money. 5% return is more than zero.

But don’t you still need to have that 10 mil in order to achieve that goal how are gonna be getting all that money

The post is showing you how compound interest works.

Sadly this would most likely only happen if it was Daily Compounding.

However, most of the time, you can only get either quarterly or annual compounding which doesn’t add up to much.

But if you could do Daily Compounding, it would definitely be nice. I have no clue where you could do it though.

If you could find multiple places that you could get daily compounding at, could you let me know?

This is just a theoretical scenario. If you’d ask someone which they would take, they wouldn’t take the compounding, they would take the straight cash. It’s more quantifiable and they can do the math. This is just to show you what compounding does and why investing should be a part of your savings strategy.

I’d do the compounding if I could find daily compounding.

Other than that, I’d take the straight cash as quarterly and annual compounding don’t make much difference compared to daily compounding.

But it is a nice theoretical scenario.

Well, I’d doubt you’d get either scenario. I’d take $1,000 a day too if I couldn’t find a place to compound daily.

Tell me Grayson, are you a millionaire? You give the advice but why aren’t you doing it yourself?

Lisa, did you read the post? Did you understand the concept I was telling you about? This has nothing to do with being a millionaire. This has to do with the basic principles of math and how investing and saving will get you to become a millionaire. No, I’m no millionaire, but I am doing this exact thing. Anyone who puts money into an interest bearing account or invests is doing it. This is for the people who think investing is stupid or they don’t have any money to save. This is to show the true power of compound interest. Please don’t put up a comment like this without reading the full post and understanding what it’s talking about. This post is showing people why they should invest and save their money.

Saving money is a great start, but at these low interest rates won’t help you too much. I sometimes cringe when I see a friend or family member put a few grand in a CD. All that money locked up for 6-months, a year, and you are only getting a 1% return? I guess it’s better than no interest!

I always recommend investing to friends and family. You don’t have to go crazy and try to find the next best thing, but it’s one of the best ways to grow your wealth. Most online brokers’ fees are relatively cheap these days. Plus, if you don’t have the time to research stocks, you can always get a decent return with an index fund.

When I find that 100% daily return, I stop by and share it here!

Yeah, I recommend investing as well. The saving part is for those who don’t save any money at all. I wouldn’t recommend anyone put everything they have in an investment account. Need to keep some close and safe from market dips.

Absolutely. Always have cash ready for dips in the markets.

Agreed!

So basically the point of this post was to lure people with a headline that is theoretically improbable (at best) and earn some money on pay-per-click basis (which is probably WAYYYYY more lucrative than investing for the average joe). Nice try. 8% is realistic and it blows by the way. Couple that with the perpetually unstable market and there’s a decent chance you’ll lose $ too. I understand you wanted to “explain how compound interest works” but it could’ve been done without baiting people with a 100% return scenario that’s totally impossible. Most people won’t even approach 1/4 of that. Be for real.

You seem to know how it all works Chloe. Let’s break down some math since 8% returns blows so much. If I have $10,000 invested and I add only $1,200 per year ($100 per month), with an 8% return and over 25 years, I now have $163,000. That really blows doesn’t it. But since you believe my only motive here it to earn some money over pay per click advertising, let’s break that down for you as well. I earn about $2.30 per day from this post alone. If it’s consistent (which PPC clicks are certainly not), then I would earn an awesome $839.50 per year. Put that over the same amount of years (25), and I’ve earned a sweet $20,987.50.

I don’t know about you, but I would take compounding at 8% any day over PPC advertising. There is a reason why the wealthy invest. The people I talk to on a regular basis don’t even know why they should save. This is an excellent reason to show them. This isn’t about baiting anyone. This questions people understanding of the concept. Most people would take the $1,000 per day as it seems larger instead of the paltry $0.01 compounded daily. It’s the exact same concept going on in your savings account or investment account.

Again, no where in the article did I say this can happen to you. I even note the 8% average over the last 30 years. Yes, I’m losing money right now in the market, but it will go back up. We all lost money in 2008, but I kept in and gained it all back plus a lot more. That’s how the market works.

So, before you try to comment on my intent with something, please think really hard about what you’re going to say. Unless you have all the facts and know what I do, then don’t accuse me of doing anything. Obviously, my math shows for itself.

Well, you are not really doubling $.01 every day…

you only double $.01 the 2nd day…

after that, you are doubling the previous day,

not the $.01

Actually, that’s how doubling works. When you double something on a consecutive basis, you double the previous amount and do on. I didn’t say add $0.01 per day for 30 days, I said double.

I think the most important point about this article that should be brought up is not to use BETTERMENT! It is not a good investing platform for the average user the returns are well below average and a lot of people are seeing negative returns with the platform. I would not wish betterment on my enemies it is a garbag investment strategy there are many better and simpler sites to use.

I think that is a little harsh. I’ve used the platform for nearly four years and have a great return. 8% average between two different accounts and 12.4% in my IRA. The platform works and they handle billions in assets. I know well over 300 people who use it and love the platform. Sorry you didn’t like it, but just because you had a bad experience with it doesn’t mean it’s not good for average investors. That’s actually what the platform is built for. Maybe your risk tolerance isn’t right. Maybe you’re holding too much in bonds (bad idea right now). If you just started investing with Betterment, you will see a negative return as that’s how the market is right now. Remember, investing is a long-term game and my account shows that it works.

I also don’t know how it could be any simpler than Betterment. You add money, set your tolerance, and you’re done. That is as easy as it gets. I’ve used well over 20 different investment platforms for research on this site and none are easier.

It’s eye-opening when you learn about compound interest. I am teaching my daughters about it at the moment. They are young so don’t quite grasp it however, never too early to learn!

My boyfriend and I were discussing it tonight and how it impacts long term. Most don’t think about it much.

Compound interest is huge. Most people don’t think it’s real, but it very much is.

I would much rather take that $100.00 and convert it back to my own currency @ 1-15 current exchange account, then invest it into an edge 28 fund regulated by government as a retirement annuity, 1500 a month at 28% return (compound interest) fixed at retirement age 60. It’s also tax deductable.

That’s an interesting way to do it. Something I didn’t consider with this one, but that wasn’t the point of the post. If you can do that with the money, then do it!

I recall many years ago an example of compound interest involving two people of the same age. One saved $2000 (at the time the IRA limit) a year starting at age 20 and stopped at age 30. The second started saving $2000 a year at age 30 and did not stop. By the time they reached age 65 the first person who only saved $10000 out of pocket had a slightly larger nest egg. I’m not skilled at spread sheets or math to verify this, but if true is remarkable.

Yeah, the one who started 10 years earlier would have a longer period of compound interest to run up against. That’s how it works. The longer you can hold it, the better. They would have saved $20,000 since it was $2k per year for 10 years.

But what happens if the market is way down when it’s time for you to retire??

We keep putting money in Iras and they keep losing money!

So it makes me feel like maybe it’s better to save but not invest.

And how often is interest compounded in reality?

I’m not losing money. I’ve invested through the Great Recession and I’m still at a positive. It’s still beating my savings account of 0.75%. Money is compounded differently depending on the account. Many are yearly, but if you don’t retire for 30 years, then you have quite a bit of earning to do. The truth is the market has returned on average, 8% over the past thirty years. This is through a few recessions. There are ups and downs. When you get close to retirement, you need to be cognizant of your investing strategy. I don’t throw everything into investments, I also have money sitting in savings account, but that won’t allow you to grow your net worth. That is just protection money, but you surely won’t be able to retire off of savings account earnings.

I’ve always loved the penny question. Compound interest is one of the amazing wonders of the world!

Compounding is a beautiful thing, in fact the earlier we start to save regularly, the earlier we retire.

First of all, you would not be saving $10 mil… You would add every amount up from the $0.01 to the $10 mil, so you would have much much more. Just because you doubled the previous day does not mean you lose that money. However, while this seems easy on paper, it is nearly impossible. No one has 1 mil pennies to double the previous million they already have. Also it’s not compound interest, it’s exponential growth. Saving pennies is an excellent idea, but don’t stress yourself on doubling the amount everyday.

What? Did you even read the post?

Compound interest is exponential growth. It’s a formula used under exponential growth. You wouldn’t have much more than that when you double each day for 30 days. It’s basic math that is pretty cut and dry in this scenario. It doesn’t turn into any other number than what is there. I think you missed the point of this post entirely.

Ok, so I’m a VERY late bloomer, so to speak. I’m 53 and deep in debt but do want to save something. Gonna try baby steps……………

I would focus on both paying down debt and investing if at all possible. You need to attack from both angles.

I don’t get it. There is a solution to saving $57k in 20 years but I didn’t see any solution to turning .01 into 10m. Other than the spread sheet but still where does that money come from. I can put .01 away and than .02 away the next day up until a certain point but eventually the numbers get too high. I don’t get what this article is trying to do haha sure $57k in 20 years is great buuuuuut it’s not even 1m let alone 10m. So is there a real program, company, or something rather that doubles my money daily or is this just some silly willy article

Not sure how the article could spell out its intent any clearer. If you’re actually looking for a way to turn $0.01 into $10 million, then keep looking and let us know when you find it. This article is showing you the power of compound interest, which many people don’t even know about. Most people don’t believe saving money will help them in the long run, but this shows if you put away money regularly and let compound interest do its thing, then it can change your life. You won’t find places that give you a 100% return, which is what the $0.01 aspect is showing you. This article is showing you math and how compound interest is a special force most people don’t care to think about. What this article is trying to do is to get people to save more money. Stop looking for a $0.01 to $10 million gag and just save your money. That’s the purpose.

The power of compound interest sure is an amazing thing!

I’m sorry this is misleading bs. No bank or investment gives you DAILY COMPOUNDED interest. I learned about compounding interest in 7th grade. Yes I read your article. I’ve also read articles on Unicorns and Saquatch.. and still find those to be bs. I understand you have to write an article headline which captivates readers and makes them click on it. It’s called click bait. There is absolutely nothing of value in this article except perhaps directing peoplE( who did not know or never thought about saving money) to investing site apps. Of course you get paid for each one that uses your link. Nothing wrong with any of that; the issue becomes the way we were herded into this article.

Looks like it got you here and to comment, so can’t complain there. See, the problem is you were intrigued on how you could grow money from $0.01 to $10 million thinking there was a way to generally do that. This is not BS, most people don’t know what compounding interest even is. People think saving and investing is not worth it to them. This article is for them, not people like you. For some reason, you thought this article was going to be the “golden ticket” to making money out of nothing. Doesn’t happen. This isn’t misleading. You can take a penny and make it ten million with compounding interest. Read through the title and realize this post is showing people how compound interest works. This is exactly what this is for. Don’t be mad at the title, since it seemed to work just fine getting you here with hopes of learning something you didn’t know.

P.S. I get paid on only 10% of the links in this article, so that wasn’t the objective.

Would be nice if you could do the 0.01 for a month and have it double each day, who has that kind of money where you can do that.

This isn’t about the $0.01 doubling every day. This is about general investing and how compound interest works. Just by putting in $100 a month, you can increase your wealth by the time you retire. Simple and straight-forward math.

Mr. Bell, this was a great article. I want to say I appreciate you responding back to the majority of the comments posted. Don’t waste your time on the internet trolls here. The article was very straight to the point and informative. If these people don’t understand it is a “theoretical scenario” they won’t get anything period. I knew about the doubling penny scenario for quite some time and clicked to just to see how you redistributed the information. You did a superb job.

For all you trolls out there:

1) there is no bank where you can get your money doubled daily.

2) this article is just an informational article to inform people of the power of compounding interest with a “theoretical scenario”

3) there is no guarantee on the market a major part of investing is dependent upon tolerance level, meaning how passive or aggressive you want your investment portfolio. It is ultimately your responsibility (how much you can tolerate, that is why there are different levels of investments (do your research and create a diversified plan to assist you with maintaining a portfolio within your tolerance level)

4) who cares how much Mr. Bell makes with this blog, at least he took the time and made the effort to post the information out there which is more than a lot of people would do.

5) before you go posting nonsense make sure you know what you are talking about because you have no idea how ignorant you really sound. Go back and re-read the post to ensure you have a grasp of the conversation.

I apologize if this is coming out strong and it is not my intent of this post to go on a bashing spree but kudos to Mr. Bell for handling each and every one of your comments in a very professional manner. I mean come on think about it, obviously you all cared in some shape or fashion about your income or your retirement and how to make it grow otherwise you would have never clicked on the link in the first place (unless you were seriously that dense in thinking you could make $10 mil from a penny and are looking for a get rich quick scheme. Take the information and use it or don’t, either way it is up to you if you want to stay broke or gain some kind of wealth. If this article gave you a solid understanding about compound interest then it was successful (even if it was only one of you).

And for the comment talking about what good is it to have that kind of money when you are near death, what about your kids or your nieces and nephews or your loved ones or even an organization in which you feel very passionate about, I mean seriously if you think that way then what is the point of having life insurance for when you die, you REALLY won’t be around to spend that money. It’s to ensure your loved ones are taken care of when you pass. Again think about what you are going to say and how it sounds before you post it.

One final response it was Albert Einstein who stated that compound interest is the eighth wonder of the world…

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

― Albert Einstein

Thank you Jason for the very kind and enlightened response. I do appreciate you coming to my defense and I’m glad you understood the point of the article.

Everyday means ordinary. You’re suggesting daily contributions, which happen every day.

Sorry you didn’t get the premise of the article Jim. Please re-read it and understand that this is a hypothetical situation just showing you the power of compound interest. The rest of the article tells you more about investing. Don’t get hung up on the $10 million scenario.

I keep a few thousand bucks in a savings account that I can get at immediately – all my bills are prepaid a few months ahead already so I don’t need keep a bigger chunk of change idle… The rest is invested in items that could take me days to get at. That is just fine as that is why i have credit cards there is absolutely little that requires you to have immediate access to cash – hospital I would put whatever I need on that plastic and by time the bill was due I would have liquidated whatever I need to for the money if it came to that. Yes…Yes natural disasters are a viable exception to the rule…but the little amount I have sitting in the bank vs letting it out and get it working for me the better… last look at my stocks I am up $215 today vs the few dollars letting this sit in the bank for an entire month … follow the rules of not investing what you cannot afford to lose but don’t let that worry scare you out of it as seriously if you are diversified properly no market piece is going to totally wipe you out…

Great post. Really good stuff here. In response to your holy interest Batman comment: I will be sure to keep tuning in here same bat time, same bat channel er uh.. I mean reading your blog.

Thanks,

GBM

Compounding is the key. Time, time, time – if I could only go back in time and invest more sooner – I would be financially free today. That doesn’t deter me however from having a plan and moving forward to eventually have the same result just later down the road. Stay in the markets long term and things will have a way for working out for everyone.