My Savings Account Interest Rate is WHAT?

In the spirit of tax time, I decided to check on my interest earnings from all of my accounts. I have 3 interest bearing savings accounts for different purposes. The account that I logged into first was my savings account at my “big” bank. This savings account is to save up for car parts for my Jeep Wrangler restore. I only purchase parts when I have the money in this particular savings account. I automatically send money into this account via electronics draft once a month, so it always gets funded. I am not going to disclose how much money was in the account, but it was less than $1,000. I mean, I am saving for car , not a car!

In the spirit of tax time, I decided to check on my interest earnings from all of my accounts. I have 3 interest bearing savings accounts for different purposes. The account that I logged into first was my savings account at my “big” bank. This savings account is to save up for car parts for my Jeep Wrangler restore. I only purchase parts when I have the money in this particular savings account. I automatically send money into this account via electronics draft once a month, so it always gets funded. I am not going to disclose how much money was in the account, but it was less than $1,000. I mean, I am saving for car , not a car!

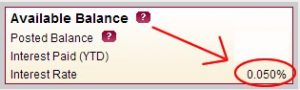

As I navigated to my interest earnings section, I was greeted by one of the worst interest rates I have ever seen.

0.050%

Yep, that is correct. My big bank was giving me a WHOPPING 0.050% annual percentage yield. I mean, what the hell? They get to provide me with some insignificant rate, while then go out and loan this money to someone for 9% APY. What a business model!

I don’t normally get upset, but I am getting screwed. This is half of the national average, which is already way too low to begin with. I only put money in the account to keep better track of it, but I didn’t expect to receive nothing for it. Ridiculous, just ridiculous.

I might move some of my money to Capital One 360. Anyone have any experience with them?

What kind of interest rate are you getting on your savings account?

I locked in a bonus rate last year at 3%, it ends in April and I shouldn’t be able to renew at more than 2.2%. Rates in the UK are much better than US, although it is still very low, I had an 8% five years ago!

That is awesome Pauline. I wish I had a luxury like that, but I don’t think we can lock in anything near that rate.

ING direct or Ally are fantastic. I used them both in Canada and the U.S.

Thanks for letting me know. I have heard good things about Ally and ING.

I’m seeing pretty much the same thing with my savings accounts. That’s pretty awesome to see what Pauline is getting with her savings. 2.2% is an awesome rate to have on a savings account.

On the other hand the only way we are going to get better saving rates at least with the banks is when the mortgage and loan rates go back up. I know when my wife started working at our local bank around 13 years ago she said some CD rates were up around 8% at that time, now we can’t get anything above a 2% on a 5 year CD. How the times have changed.

Yep, as long as the fed keep the rates down and continue buying bonds, we won’t see anything worth it. It makes saving just not worth much on paper.

Grayson,

The interest rates may as well not even pay anything, this is pittance! The real truth of the matter is the rates are not even keeping up with inflation, which is said to be about 2%. If that is the case, then your real rate of return is a -1.95%.

Sorry, we just have to find ways to better our returns, I say real estate!

I agree Jim. I forgot to think about the negative rate due to inflation, but then the article would be much longer with a more enraged rant.

I wonder how much they’re making by investing all this shall we say ‘free’ money in high yield investments.

They are making enough, much more than my worthless rate they give me.

SmartyPig offers 1% and you can get addl benefits when you cash out. Accepts scheduled payments, shows you progress toward your savings goal. I love it.

Thanks for letting me know Bobbi. I will check it out.

I don’t even know and I’m scared to look. I’m sure it’s probably a pretty similar rate.

I didn’t think it was this low, so I am glad that I looked.

Whoa that is super low. Mine was at 2% last I checked. I’ll have to check again..

2%, where are you getting a rate like that from?

I have used ING for about a year now. I love it. It’s so simple to make sub saving accounts for different goals but the interest rate isn’t anything great .75%

Thanks for letting me know Alexa. I have another savings account that is the same as your rate, but I didn’t want to move my money in there. I will either check out ING or Ally at this point.

I only have online banking accounts. My current interest rate is 0.60%. I’m sure there are other online accounts that have a higher interest rate, but from what I’ve seen, it isn’t high enough to make me go through all of the work of changing banks and setting up new automatic transfers all over again.

Yeah, I have two other accounts that are at 0.70% and that makes me stay. I was upset about how my big bank uses my money for loans, but gives me nothing for it.

Wow, that does suck lol… but rates are crap all over the place in savings accounts. Right now in our so-called High Interest savings account we get 2%.

I would rather have 2% than less than 1%. You are still winning now Mr. CBB!

Yes, unfortunately I’m finding lately that different accounts lately only help keep things organized. There doesn’t seem to be much of a benefit for interest rates.

Very true Alex. I tend to just sit money in my different accounts depending on what I need the money for.

Hah, yea, savings rates are sad. The government is doing everything in their power to incentivize you to spend your money. I’ve been keeping my money in my Fidelity cash management account but it’s not doing anything worth talking about and I recently dropped TD because it was doing worse than nothing (nothing+fees). I think it’s about time I give Ally a try, I’ve heard quite a lot about it already.

Yeah, unfortunately, I don’t want to spend my money yet. I need to save it for a down payment on a house. Their policies are kicking savers in the rear and telling them to stop saving and spend.

I use Ally and I love it. The only issue I’ve had with them in the past was with their check deposit system, but since they’ve implemented mobile check deposits, I have no complaints. I moved to Ally when I realized my bank was giving me 0.01% interest, so I feel your pain. I still don’t get a whole lot of interest from Ally (the savings account rate is currently 0.9%), but at least it’s dollars instead of cents!

Thanks for the info. I appreciate it and it will make my decision easier.

Wow, that is extreme. This is the lowest interest rate I’ve ever seen. Mine is 3%. I don’t have any experience with Ally but I think that whatever bank you choose would be better than this one. 0.05% is less than nothing. It’s a joke.

I’ve heard a lot of great things about Ally and their customer service seems second to none. I haven’t made the move, because I’m with ING for saving money, but they’re equally as good.

Those are the ones I am between now. I will just have to do it and let people know how it went.

You made me look, mine’s at 0.060%. This is ridiculous!

Ouch, time to move to another service.

I hear what you’re saying! Mine is 0.075% right now. Thinking about moving it to CIT for 1%.

I would say move. That is also a bad rate.

I’ve been doing Tax Free Savings Accounts for the past few years with my financial lady at Primerica here in BC, Canada. I can’t remember the interest rates off the top of my head, but they were far above what any banks I’ve seen have offered. Also, I have been doing mutual funds with her since 2001. The interest rates are up and down, but one year we made close to 20% – that’s right, TWENTY percent. Talk to a financial adviser at Primerica. They don’t make money unless you do, so they really work hard to find the right places to put your money.

Nice to hear about your experiences with Primerica. I don’t live in Canada and don’t have access to Primerica, but I moved most of my money into other accounts that actually earn.

I’m getting 0.99% at Ally and love it!

Nice! I moved my money from the low interest bank to a credit union. Much better!