How Are Your Retirement Savings Shaping Up?

As the new year begins, I have been putting more thought into how I have been doing with my retirement savings. When I was getting out of debt, I decided to wait to pull money out of my paycheck and fund my retirement fully. I feel that I made the right choice because I was paying over 13% interest on my credit cards. Since I don’t believe I would have been making those type of returns in my 401k, I think I made a good financial decision.

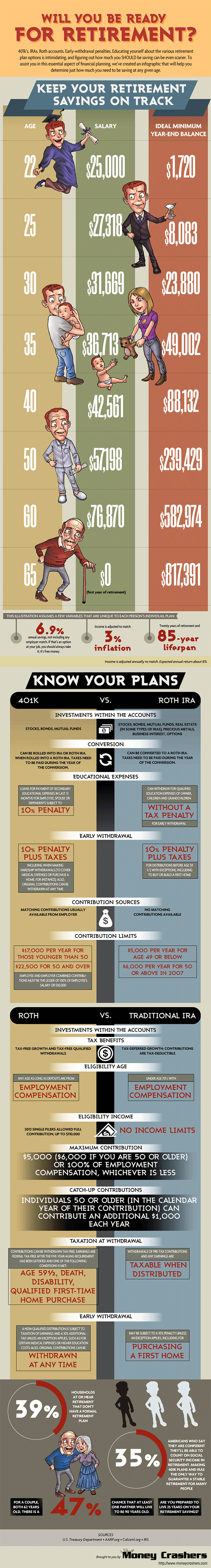

As I look toward creating some great goals for 2013, I had to put my retirement savings under the microscope. How am I doing now that I am funding it? How much more do I need to save? When do I want to retire? All of these questions are great and can be easy to deal with with the right resources. Luckily for me, I was able to locate a great infographic from Money Crashers. They ask the simple, yet powerful question, “Will you be ready for retirement?”. Find out below!

“How Much to Save for Retirement – Are You Ready?” – An infographic by Money Crashers Personal Finance

Post Thumbnail Photo via Tax Credits

I really enjoyed your graphic. Suprised to see that you need a balance of 1,720 by age 22 though.

Hello Brett. I am glad you enjoyed it. $1,720 is not that much, but it is a great start.

Good infographic! It amazes me the numbers of people at or near retirement that have no plan for it. We’re looking at ours this year as we want/need to establish a SEP IRA for our business. Thankfully business has gotten to the point that we can start putting money away again and a SEP offers higher contribution limits.

It is amazing and scary at the same time. Good luck with your SEP IRA and I hope you are able to fund it well.

Nice infographic! I don’t have a special amount set for retirement, everything is in a common investments pot, but am ahead of the suggested amount. Plus entitled to a teeny tiny pension in France and the UK, if those things still exist by then!

As long as you are investing, then you should be ok. Just make sure you are investing enough.

I am right on track with the graphic, but I SHOULD have much more. I just turned 27, and have $17k put away. But, my income is double the suggested income, so I should probably have closer to $35k-$40k put away. I just doubled my 401k contribution, so hopefully that helps!

Good to hear Jacob. I need to increase my contribution and will be doing so very soon. I had changed it earlier, but the HR department never submitted the paperwork.

I do enjoy a good inforgraphic, but they are already out of date! The IRS upped the limits on IRAs and 401ks for 2013 which is great news! I think they probably should have at least mentioned RMDs (required minimum distributions) when talking about differences between a ROTH and a Traditional IRA. But like I said above… I do enjoy a good infographic!

You are correct Brian. It is hard to keep up with what the government is doing these days. It still provides a solid picture of where you need to be.

Great infographic! I’m happy to report that my Roth is fully funded each year and I’m contributing to a 401K and 403b (multiple jobs). My next goal is to figure out the best course of action considering the 401k/403b accounts would grow more if combined. Need to figure out a way to do that without quitting either job…haha!

That is an excellent position to be in. Good luck on combining them without quitting your job.

Great find with the infographic. I hope to have a lot more money saved up than they’re suggesting!

Thanks and that is always a good goal to have!

My retirement is not nearly where it needs to be. I’m afraid I started a little late due to being in so much student debt, and making so little when I first finished undergrad, but I’m trying to get back on track now. At least I have some retirement savings, that’s better than many of my friends.

That is understandable. At least you are working on it and it all takes time. Good luck KK!

Great graphic. I hope the $817k is all that is needed for a comfortable retirement; but, I’m afraid I’ll need a lot more. Obviously, though, everyone is different.

It depends on how much you want to use each year. I think it would be better to have more than $1 million.

Good article. I would add that in a 401k you are limited to the plans investment options. This can mean a lower return than in a traditional IRA, where there are no plan limits. The best bet for dealing with these limitations is to stick to ETFs and avoid mutual funds.

You are spot on with this assessment Aram.

Thanks for sharing your views and experiences and this had been a great help for me and plus for those who are willing to invest in 401K.

You’re welcome!